Adding to the complexity is the fact that the true rate of take-up for sublease space is difficult to calculate, given that sublets have a defined term and may “burn off” before being leased, returning to the market as direct available space. Today’s environment is also totally different – more extreme than what had been considered the “worst of times” during the Great Recession of 2008-2009 – and future circumstances are difficult to foresee. The most rapid decrease in available sublease space was recorded during the 13 quarters from second-quarter 2004 to third-quarter 2007, when available space fell by an average of nearly 80,000 sf per quarter.ĭo these historical perspectives provide any insight as to how the market will respond this time around? Immediately noticeable is the fact that there is no relationship between the rate of take-up in the last three peak-to-valley cycles, spanning 20 years, in either Downtown Toronto or the GTA as a whole. By comparison, downtown accounts for 48% of total GTA sublease availability today. At year-end 2013, downtown subleases accounted for 38% of the GTA’s available sublease space – and the space took longer to “burn off” than in the GTA as a whole. The most recent peak-to-valley cycle took 21 quarters, from fourth-quarter 2013 to first-quarter 2019 – during which time sublease availability retreated by slightly more than 41,000 sf per quarter, on average. Similarly, three sets of peaks and valleys were identified in Downtown Toronto. The most rapid decline was recorded in the previous cycle, from third-quarter 2010 to first-quarter 2012, when available space declined by more than 233,000 sf per quarter, on average, over a period of six quarters. During this time, sublease availability declined by an average of almost 134,000 square feet (sf) per quarter. For example, the most recent peak-to-valley in the GTA spanned 15 quarters between fourth-quarter 2013 and third-quarter 2017.

For each cycle, we determined the length of time between the peak and the valley, and the rate of contraction in sublease availability. We have identified three sets of peaks and valleys in GTA sublease availability. Let’s begin by looking at the GTA market as a whole. The charts below illustrate the amount of office space available for sublease in both the GTA and Downtown Toronto, measured quarterly over the past 20 years. At the best of times, forecasting market activity can be difficult, but given these unprecedented circumstances and a lot of unknown variables, we have taken a “rear-view mirror” approach, looking at what’s happened in previous cycles to make some hypothetical assumptions about how the sublet market could retreat this time around. With available sublease space continuing to mount, it remains to be seen how much further this figure will grow, and how long it will take for this space to be leased and return availability to pre-COVID-19 levels.

Meanwhile, Downtown sublease availability has risen from 1.7 msf to nearly 2.5 msf – and is up from just 652,000 sf at year-end 2019. During this two-and-a-half-month span, the amount of available sublease space across the GTA office market has risen from 3.7 million square feet (msf) to 5.1 msf – for reference, this is up from 2.4 msf at year-end 2019.

#POSTVIEW PRINCIPAL CURVATURE UPDATE#

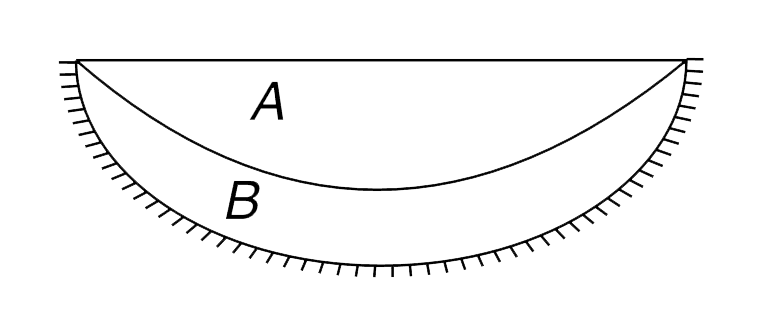

Since our last update in August, the tide of available sublease space has continued to rise and has actually accelerated during the fall months. More than two months down the road, it’s time to check in with the market and take another look. At the end of August, our previous blog took an in-depth look at the office sublease market in the Greater Toronto Area (GTA) and raised the question of whether tenant demand would be sufficient to “flatten the curve”.

0 kommentar(er)

0 kommentar(er)